Table of Content

Likewise, you will want to seriously consider when is the right time to initiate your claim. The waiting period often corresponds to the benefit period, or the maximum amount of time that the insurance company will pay benefits. Often, the longer the waiting period before benefits begin, the longer the company will pay for your care. Home care services cover a wide range of needs, from homemaking and companionship to meal preparation and medication reminders.

Although minor and infrequent medical services, such as first-aid for a wound, can sometimes be met on-site by nurses. These communities may sometimes also be called ALFs, residential care facilities, retirement homes, or long-term care facilities. GTL's Short-Term Home Health Care Insurance can help you cover deductibles and co-payments for home health care services. It also includes a Short-Term Home Health Care Aide Benefit, a Prescription Drug Benefit and a great set of riders for you to choose from. According to the National Center for Injury Prevention and Control, falls are the leading cause of injury among the elderly.

CONCIERGE CARE

Couples, where both partners sign up for Mutual of Omaha, can receive 15% off their policies. In situations where only one partner of a long-term relationship has a policy with the company, a 5% discount applies. There's a third discount available to customers for being in good health regardless of their relationship status; eligible customers can save 15% from their bill. A married 60-year-old female can expect to pay between $160 and $319 per month for $2,100 to $4,100 in monthly benefit amounts, while a married 70-year-old female can expect to pay between about $249 and $497 for the same coverage amounts. A married 75-year-old female can expect to pay between about $363 and $726 monthly. New York Life offers a choice of plans, flexibility of care, high daily coverage limits, and a money-back guarantee.

This means they must communicate regularly with you, your doctor, and anyone else who gives you care. With Amwins by your side, you not only get industry-specific expertise and data-driven insights - you get a direct extension of your team.

The Ability To Remain In Your Own Home Is One Of The Greatest Benefits Of Owning Long-Term Care Insurance

"And find out if the agency or provider performs unannounced quality assurance visits to the client's home. These are two of the most important activities that home care agencies should be performing." Home health care is a wide range of health care services that can be given in your home for an illness or injury. Home health care is usually less expensive, more convenient, and just as effective as care you get in a hospital or skilled nursing facility . For over 40 years, Amwins Program Underwriters’ Home Health Care program has offered tailored insurance solutions for medical suppliers, equipment providers, drug distributors, visiting nurse associations and other agencies. Age, location, plan features, and maximum benefit selections are all factors that can affect the overall cost.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Founded in 1909 and with an AM Best rating of A+ , Mutual of Omaha offers one long-term care base plan. With three types of discounts offered (the potential for up to 15% in savings), Mutual of Omaha is our top pick for those looking for discounts on their long-term care policy. Full BioMary is a journalist with 14+ years of professional writing experience, her work has been published internationally by Forbes, HuffPost, Business Insider, The Points Guy, AOL, and SheKnows. Philadelphia Insurance Companies specializes in the Home Health Care Industry.

What It helps provide benefits for

You must be under the care of a doctor, and you must be getting services under a plan of care created and reviewed regularly by a doctor. The UNL Home Health Care Shield, Short-Term Home Health Care Insurance, pays cash benefits directly to you. Enjoy the option to recuperate in the comfort of your own home with help from falling behind financially. We'll show you how to implement Client Training Services and Risk Management Reporting that get results. GTL will pay a benefit amount of $10 for each generic or $25 for each brand name prescription drug up to a policy year maximum of $300 for Plan A, $600 for Plan B or $600 for Plan C. You can choose a daily benefit amount of $40/day for Plan A, $80/day for Plan B or $120/day for Plan C.

As such, they can reduce a family’s out-of-pocket care costs or reduce the hours they spend providing care themselves. Before you start getting your home health care, the home health agency should tell you how much Medicare will pay. The agency should also tell you if any items or services they give you aren't covered by Medicare, and how much you'll have to pay for them. The home health agency should give you a notice called the Advance Beneficiary Notice" before giving you services and supplies that Medicare doesn't cover. On the other hand, a home care registry is an organization that helps you locate a caregiver and places one in your home on an independent contractor basis.

When an elderly person falls, they are more likely than younger people to end up in the hospital and often, to come back home unable to perform their normal activities. If a fall has already occurred, home care may be an appropriate intervention during recovery. Just because you cannot walk up a flight of stairs unaided, does not mean a move to a facility is required as a permanent decision. Long-term care insurance can fund home care that will allow you to remain at home where you are most comfortable, with safety and independence. If your doctor or referring health care provider decides you need home health care, they should give you a list of agencies that serve your area.

Suburban’s nurses, therapists, and aides are located throughout the Greater Boston area including Suffolk, Middlesex, Norfolk, Essex, and Bristol counties. Suburban’s dedicated bilingual caregivers speak English and 16 other languages, including Spanish, Cantonese, Mandarin, Vietnamese, Portuguese, and Russian. She was able to recuperate with professional help in the comfort of her own home while re-building her life with therapy and pathology services.

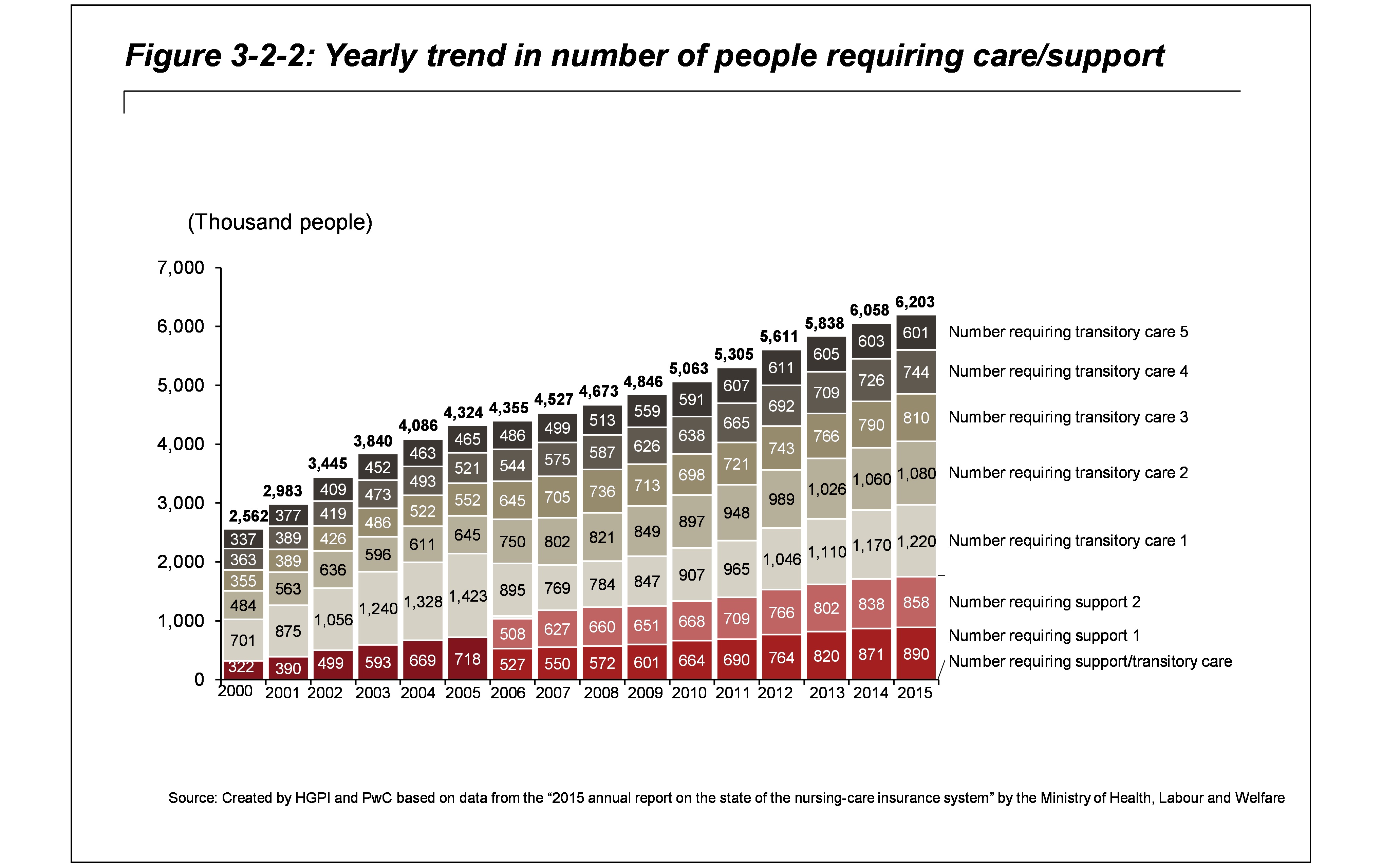

This longer life, though allowing us to have greater life experiences, also increases the chances that we will experience long-term illnesses that require help in order to continue living safely in our homes. Activities of daily living (ADL's) is a term you might hear that refers to the things we do on a daily basis to take care of ourselves, including bathing, dressing, and using the bathroom. Named one of the best life insurance companies of 2022 by our team at Investopedia, New York Life offers two types of long-term care insurance. Its combination long-term care insurance plan offers—as the name suggests—a combination of long-term care or a larger life insurance benefit. Long-term care coverage is offered for the expenses related to a range of choices, including care from a facility, care at home, or care from a family member.

Suburban is a family owned, Medicare and Medicaid certified agency, who consistently ranks among the top in Massachusetts in quality of care. Medicaid is an option, but only for those who meet certain financial eligibility requirements. Yet for many without these options, LTC insurance is a way to reduce the costs of potential long-term care. You can usually apply for a quote online or with an agent over the phone, and if you have questions, you can speak with the agent or customer service to get more details. The company is best for easy benefits payouts because it doesn’t require receipts and dependents can receive payouts. Additional benefits are available for an extra cost, such as inflation protection, shared care , and a return of premium for any benefits not used.

For home and community-based care, customers can choose from 50% to 100% daily coverage. Lastly, customers can select their specific waiting period—the time individuals will have to pay for services out of pocket before coverage kicks in—with a choice between 90 or 365 days of waiting. The company rises above the competition and is best in our review for no-waiting period plans. These are its MoneyGuard II and MoneyGuard III policies, both of which offer zero-day elimination periods for accessing coverage for nursing homes and assisted living facilities.

Lincoln Financial Group offers four plans with no waiting periods and it also provides benefits to those living abroad. Seniors who have private health insurance may find those plans will cover home health care in a limited capacity. Most private plans cover a portion of the cost of skilled in-home care but do not cover non-medical home care at all. For this reason, it’s important to read policy documents carefully and plan ahead when it comes to paying for long-term care for seniors. Her plan allows her $300 per day in benefits for skilled nursing care and lowers the costs of her medications. Your doctor or other health care provider may recommend you get services more often than Medicare covers.

Other companies on this list generally require a minimum of 90 days before granting coverage for such services. If you need long-term care insurance, all of the best long-term care insurance providers on our list are viable options depending on what you need. Some companies don’t require waiting periods and others offer convenient online quotes without having to speak to an agent.

No comments:

Post a Comment